ESG Policies

1. Please provide your ESG-related policies. Please provide a formal statement of your ESG-related policies if you have one.

Fiera Capital’s Sustainable Investing Policy outlines the firm’s approach to integrating ESG assessments into investment processes and highlights the many benefits of increasing our knowledge of companies in which we invest, better controlling the risk of our portfolios and helping companies improve over the long term. The policy also provides a blueprint for “active ownership,” which includes the tactical use of proxy voting rights and engagement with the management of companies in which the firm invests in order to address ESG issues and affect positive change.

The Firm’s ESG-related policies are reviewed annually and updated as needed to ensure that they are effective and in line with best practices.

Fiera Capital’s Sustainable Investment Policy and Proxy Voting Guidelines enclosed.

2. Are sustainable investing and ESG factors integrated into your investment process and portfolio management decisions? If yes, please provide details.

We are committed to ensuring that ESG considerations are fully integrated into our investment processes. We believe that for ESG factors to be well integrated within the investment decisions we make, investment teams must be accountable for their ESG integration processes. This belief guides the way our investment teams implement their strategies, conduct materiality assessments, and integrate ESG factors in a manner that best suits their respective asset class, investment style and geography.

Integrated Fixed Income Team:

The Integrated Fixed Income team takes a comprehensive approach to sustainable investing by combining ESG factors into their corporate credit framework. By including such factors in the investment process, the team seeks to gain greater insight into a company’s ability to manage risks and its ability to create sustainable value over the long term. If an area of concern is identified, the team assesses the potential impact this may have on the financial performance of the issuer. Additionally, when the team believes there could be a material impact on the business or financial profile of the issuer, it is factored into the assessment of the issuer’s securities through a modification of the team’s judgement of the required returns to compensate for the additional risk factors.

As the team seeks to gain greater insight into a company’s ability to manage risks and its ability to create sustainable value over the long term, we must identify which, if any, ESG factors may have a material positive or negative impact on a company and determine if the compensation is commensurate with the risk. By digging deeper, a competitive edge can be gained through a better understanding of how traditional financial and non-traditional non-financial factors can influence a company’s costs, risks, opportunities and competitive advantages. Therefore, in every company research report produced, we include a formal ESG section highlighting both positive and negative ESG aspects that our credit analysis has identified. The results of this analysis feed directly into the valuation conclusion.

See a detailed overview of the integrated approach in the chart below:

While ESG-related concerns can affect the team’s investment decisions, the credit selection process does not necessarily preclude investment opportunities based on ESG factors alone since the team recognizes that ESG factors are often intertwined with other factors that can affect the risk-return assessment of a given security. As part of their credit research process, the IFI team elects to regularly engage with issuers on ESG related subjects with the goal of expressing concerns and positively impacting issuer behavior. The team believes that engagement can improve issuer performance and reduce companies’ risk profiles, while better aligning issuers’ behaviour with client interests. To this effect, the team records the number of engagements they participate in and closely track ESG milestones. As the team actively participates in funding discussions with corporate issuers on an ongoing basis, the team’s exposure to management teams is significant and the nature of the discussions gives the team the right levers for engagement which has led to companies adopting the recommendations of the team’s analysts (i.e. greater board diversity, increased transparency in reporting, etc.).

Scoring methodology

The Sustainable Investments team has developed a proprietary Fiera ESG Score to enhance the data infrastructure, identify points of ESG engagement, and improved client reporting. The most significant deficiency from third party ESG rating providers is the ESG rating coverage of Canadian corporate bond issuers. Our assessment of Fiera’s current ESG data provider reveals they provide data on only 61% of the corporate issuers in the FTSE Canada indices.

The Integrated Fixed Income Team in collaboration with Fiera’s Sustainable Investments team developed the Fiera ESG Score where the team now has E, S, G and Overall ESG Scores for 100% of the 230 Canadian corporate issuers.

The Fiera ESG Score is based on publicly available ESG scores by a leading ESG Research provider – this forms the fundamental basis of issuer ESG ranking methodology across the Canadian corporate universe:

- Focus on underlying E, S and G scores ranging from 0 to 10.

- Overall ESG score is a weighted average of industry dependent weights applied to each E, S and G criteria.

Fiera has flexibility to adjust the E, S and/or G components, if deemed appropriate, based on assessment from the credit analyst covering a given issuer:

- Adjustments can be max +/-2 notches for each E, S and G component.

- In cases of adjustments, the Overall ESG score gets recalculated.

For issuers that do not have an external ESG rating, data gaps are being filled with:

- Global average scores for E, S and G based on the issuer’s sector.

- Potentially adjust E, S, and G component, to a max +/-2 notches

- Overall Issuer ESG Score is calculated based on global average sector weightings for E, S and G components.

Independent governance and oversight of all issuer ESG Scores is performed by the Risk and Sustainable Investments teams. Fiera applies a similar process to improve coverage of issuer emissions data with a focus on Scope 1 & 2 emissions, as well as carbon intensity metrics.

Our proprietary ESG scoring also allows for customization to achieve client objective. This may include Fossil Fuel Free portfolios that excludes debt from energy companies, as well as issuers in nonenergy sectors with high carbon intensity, strategies focused on excluding issuers with a high risk of loss from current or past controversies and carbon intensity focused portfolios that seek to reduce the portfolio’s carbon footprint over time or relative to a benchmark.

3.a. Are you a signatory to the UNPRI?

Yes, Fiera Capital has been a Signatory of the United Nations Principles for Responsible Investment (UNPRI) since 2009.

3.b. If you are signatory to other coalitions, please list them.

Fiera Capital interacts and participates in a number of industry work groups on ESG reporting standards. We believe that part of being a responsible investor is to actively contribute and collaborate with other players in the investment value chain to further develop the field. We therefore endorse or sign relevant standards and statements and are active members and signatories of various networks and Responsible Investment initiatives. We furthermore consider a range responsible business conduct codes and internationally recognized standards for due diligence and reporting.

In 2024, we participated in various sustainable investing initiatives, industry associations, and working groups, including the following:

Better Buildings Partnership (BBP) Climate Commitment: Fiera Real Estate UK joined the Better Buildings Partnership (BBP) as of October 2022 and has signed up to the BBP’s Climate Commitment. The BBP Climate Commitment acknowledges the transformation that is required across the real estate sector to deliver net zero buildings by 2050. The aim of the Commitment is to: leverage collaborative and tangible strategic action on climate change, increase transparency and accountability enabling the market to operate and compete effectively, and provide clear client demand for net zero assets, driving the industry to respond.

Canadian Coalition for Good Governance (CCGG): CCGG promotes good governance practices among public companies in Canada, with a strong focus on independent board members of corporations. CCGG is increasingly focusing on environmental and social factors when engaging with board members.

Canadian Fixed-Income Forum (CFIF): CFIF is a group set up by the Bank of Canada to facilitate the sharing of information between market participants and the Bank on the Canadian fixed-income market. An ESG committee was created by CFIF and several other sub-committees and working groups were then created to work and issue recommendations on several themes and issues. Members of Fiera Capital have created and chaired a working group on ESG data which seeks the betterment of ESG disclosures by Canadian Issuers through collaborative and direct engagement.

Carbon Disclosure Project (CDP): We are a signatory to the CDP, a project that aims to collect and share information on greenhouse gas emissions and climate change strategies.

Climate Action 100+: Fiera Capital is a part of the Climate Action 100+ investor engagement initiative, which addresses climate change with some of the world’s largest corporate emitters of greenhouse gases. As a member of this initiative, we participate in engagement activities centered around key goals: companies reducing their greenhouse gas emissions, implementing a strong governance framework that clearly articulates the board’s accountability and oversight of climate-related matters and improving their climate-related disclosures.

Climate Engagement Canada (CEC): In 2023, we became a member of Climate Engagement Canada (CEC), a finance-led initiative that drives dialogue between the financial community and corporate issuers to promote a just transition to a net zero economy. CEC focuses on select Toronto Stock Exchange-listed companies that are strategically engaged for the alignment of expectations on climate risk governance, disclosure, and the transition to a low-carbon economy in Canada. CEC’s Focus List companies have been identified as the top reporting or estimated emitters on TSX and/or with a significant opportunity to contribute to the transition to a low-carbon future and become a sectoral and corporate climate action leader in Canada. These firms operate across the Canadian economy in the oil & gas, utilities, mining, agriculture & food, transportation, materials, industrials, and consumer discretionary sectors. Since joining the initiative, we have joined a total of 7 engagement collaboration groups.

Global Real Estate Sustainability Benchmark (GRESB): GRESB is a well-recognised global ESG benchmark for real assets, representing approximately USD 7 trillion in gross asset value (GRESB 2024 Real Estate Assessment). Over 150 institutional investors, including Fiera Capital, use GRESB data to monitor their investments and make decisions that contribute to a more sustainable industry. We use GRESB in our infrastructure and real estate strategies and participate in the annual reporting it requires.

Impact Management Norms by Impact Frontiers: Formerly known as the Impact Management Project, the framework was initially backed by many foundations, asset owners, and asset managers around the world and aimed to provide a framework for impact measurement. This framework is currently used in our Global Impact Fund, which was launched in 2020.

Net Zero Asset Managers Initiative (NZAM): As an investor signatory since June 2021, Fiera Capital is committed to supporting the goal of net zero greenhouse gas emissions by 2050, in line with global efforts to limit global warming to 1.5 degrees Celsius. We are also committed to supporting investments aligned with net zero emissions by 2050 or sooner.

Responsible Investment Association (RIA): The RIA is Canada’s membership association for Responsible Investment. Members believe that the integration of environmental, social and governance factors into the selection and management of investments can provide superior risk-adjusted returns and positive societal impacts.

Sustainability Accounting Standards Board (SASB): SASB is a framework with growing global recognition. As an official supporter since 2020, we have promoted the standards internally, and it is used by an increasing number of Fiera Capital investment teams.

Task Force on Climate-related Financial Disclosures (TCFD): We are an official supporter of TCFD. The task force’s recommendations provide a foundation for climate related financial disclosures for all companies, encouraging them to report on the climate-related risks and opportunities most relevant to their particular businesses. In 2024, the IFRS Foundation took over the responsibilities from TCFD. The IFRS S2 standards are intended to replace the TCFD as the global climate reporting baseline.

Principles for Responsible Investing (“PRI”): PRI is an investor initiative focused on incorporating ESG into investment processes. Fiera Capital was an early adopter of responsible investment and signed the PRI in 2009. As a signatory, we are continuously assessed on our performance and required to report annually on our ESG integration approach and progress.

UK Stewardship Code: Fiera Capital has been a signatory to the UK Stewardship Code since 2022. Signatories of the UK Stewardship Code are required to annually report on their stewardship policies, processes, activities and outcomes for a 12-month reporting period, setting a high stewardship standard.

3.c. Indicate any other international standards, industry guidelines, reporting frameworks, or initiatives that guide your responsible investing practices.

Please see question 3b)

4. Please describe how ESG oversight and integration responsibilities are structured at your firm, including the process for escalation of key ESG issues. Also, if applicable, describe how responsible investment objectives are incorporated into individual or team employee performance reviews and compensation mechanisms.

Governance and oversight of our sustainable investing practices is a shared responsibility at Fiera Capital, involving various business divisions and functions to ensure we continue to enhance our capabilities in the years to come.

Global Sustainability Committee

Our business-wide body is responsible for steering the global sustainability strategy. The Committee is responsible for overseeing the implementation of the company’s sustainable investing and corporate sustainability strategies. The Committee reports to the Executive Committee on its activities.

Sustainable Investing:

- Leads Fiera Capital’s sustainability vision and objectives internally and externally, demonstrating full leadership support.

- Collectively develops and sets Fiera Capital’s strategic objectives and vision as it relates to sustainable investing.

- Established and regularly reviews policies to ensure their effective implementation.

- Monitors sustainable investing practices implemented by Fiera Capital’s investment teams.

- Ensures the required sustainable investing infrastructure and resources are available to achieve strategic objectives, including internal and external (ESG specialists and resources, ESG data providers, systems and databases.

- Monitors and develops any external relationships, memberships or collaborations in relations to sustainable investing, including vendors and suppliers.

The committee members are as follows:

- Executive Director, Global Chief Legal Officer and Corporate Secretary (Chair)

- Executive President and Chief Investment Officer of Public Markets

- Chief Investment Officer and Head of Private Markets Solutions

- Head of Sustainable Investing – Private Markets

Sustainable Investing Team

The Sustainable Investing (“SI”) team is responsible for overseeing the implementation of Fiera Capital’s Sustainable Investing strategy by partnering with all investment teams. They serve as a center of sustainability excellence and a resource to promote continuous improvement in ESG integration across all our investment strategies. Together, they seek to provide transparency to our clients and ensure that Fiera Capital complies with applicable regulations. They actively communicate with the Global Sustainability Committee to share ESG information and seek approvals for policy positions and collaborative initiatives.

Our Dedicated Sustainable Investing Resources:

CIO Office – Public and Private Market Divisions

The CIO offices of Fiera Capital’s Public Markets and Private Markets divisions are responsible for ensuring their respective investment teams have sufficient resources and support to enhance their ESG capabilities over time.

Investment Teams

The investment teams are accountable for implementing their own ESG integration process in a way that best suits their investment style and asset class.

5. How do you obtain ESG information/data (e.g. public information, third party research, reports and statements from the company, direct engagement with the company)? Please provide specific details of what information is obtained from each source, and how this information is acquired.

Fixed income teams benefit from the in-house expertise of the firm, draw upon the expertise of specialists and generalists and maintains a proprietary database of select current and historical ESG factors affecting Canadian corporate issuers. The analysis of ESG factors is performed based on various sources of information such as company disclosures, discussions with management, news items and third-party information from our external ESG research provider MSCI and Bloomberg. Insights generated by the database and other sources are used to generate engagement points with issuers and facilitate the discussion with management teams.

6. What channels do you use to communicate ESG-related information to clients and/or the public? Do you produce thought leadership (written reports and publications)? If so, is the information available to the public? Please provide links, if applicable.

We recognize the importance of transparency and report on ESG integration as well as progress on our sustainable investing objectives. We regularly report on issues of ESG relevance via our website and through our Annual Sustainable Investing Report and Climate Report.

The below reports can be made available to clients, as well as the potential to customize reports that incorporate ESG metrics that are important to a client:

- Extended Portfolio Summary Reports: generated using MSCI ESG research, the report shows overall scores between portfolio and reference benchmark. It also provides high-level metrics on carbon footprint and controversy risk within the portfolio.

- Proxy Voting Results (for equity mandates only): generated using proxy voting results from ISS. We can provide greater details on votes executed over a specified period. For example, percentage votes against or for management, number of votes by proposal categories, etc.

- Carbon Metrics and Attribution Reports: Using data from MSCI ESG Research, we have built our own customized carbon metrics and attribution reports that compare the carbon footprint of a portfolio against its reference benchmark. The attribution report helps identify where the difference in total weighted average carbon intensity is coming from. For example, is it due to sector allocation (allocation to sectors that are less carbon intensive) and/or security selection (within a sector, does the portfolio manager choose companies that are less carbon intensive than their peers)?

Furthermore, additional ESG-related information may also be made available to clients and beneficiaries upon request.

7. Do you have periodic reviews of your ESG process/approach to assess its effectiveness? What are the results? What would cause you to disregard ESG issues in your investment/analysis decisions?

The Firm’s ESG-related policies are reviewed annually and updated as needed by our Sustainable Investing Team to ensure that the policies are effective and in line with best practices.

UN PRI performs an annual assessment on our fulfilment of the six principles of sustainable investing. Our latest scores in 2024 reflect the collective efforts of every area within our firm in ESG concerns.

Climate

8. Describe how you identify, assess, and manage climate-related risks, and whether climate-related risks and opportunities are integrated into pre-investment analysis.

Environmental, social and governance (ESG) factors, including climate-related ones, are integrated into the fundamental investment decision-making process of the Integrated Fixed Income strategy, whose investment processes reflect the belief that organizations that successfully manage ESG factors create more resilient businesses/assets and are better positioned to deliver sustainable value over the long term. The team takes a comprehensive approach to sustainable investing by combining ESG factors into their corporate credit research framework. When the team believes there could be a material impact on the business or financial profile of an issuer due to ESG concerns, it is factored it into the assessment of the issuer’s securities and the evaluation of the required returns needed to compensate for the additional risk.

The team leverages ESG data (including climate related data) as well as Fiera’s internally developed ESG scores to help drive investment analysis. The team is of the view that climate change related risks are becoming increasingly important in fundamental analysis due to the potential material impacts these risks may pose to companies’ long-term value prospects.

The team breaks down climate related risks as follows:

- Transition risks: transition risks are often easy to identify and are assessed using the team’s internal credit analysis as well as ESG data from external providers. According to the UN PRI’s “Inevitable Response” document, certain sectors are more exposed to transition risks than others, and higher risk companies often lag their peers in terms of carbon emissions (higher carbon intensity) as well in metrics measuring preparedness and transition planning.

- Physical risks: physical risks are more difficult to identify and monitor – the team is aware of the development of tools to better capture the potential impact on portfolio returns; however, these still need to be refined. When the team believes there could be a material impact on the business or financial profile of an issuer due physical risk concerns, it is factored into the assessment of the issuer’s securities and the team modifies their judgement on the required returns to compensate for the additional risk factors.

When the team believes there could be a material impact on the business or financial profile of the issuer it is factored into the assessment of the issuer’s securities, or the team modifies its judgement on the required returns to compensate for these additional risk factors. The following examples highlight our approach:

- We had been very cautious with regard to several German auto makers in light of the widespread emissions scandal (i.e. Dieselgate). Besides the environmental and governance issues tied to the scandal, we were also concerned with the impact of potential litigation costs. As a consequence, for an extended period of time and throughout 2019 and into 2020, we closely monitored our existing exposures to the sector and actively passed on new issues of several particularly affected issuers. By actively trimming exposures, we brought down our exposure to a level with which we were comfortable.

- We currently have a negative outlook on the industrial auto sector due in part to ESG-related concerns as several automakers have announced pauses or partial rollbacks of their EV transition plans amidst falling demand, margin pressures, and shifting political support for green initiatives in the US. There is also an outstanding controversy regarding allegations of coercive practices in employment of ethnic minorities in the Xinjiang Uyghur Autonomous Region (XUAR). This is a widespread controversy across the auto industry, and while many automakers are not implicated directly, the alleged coercive practices are occurring in the supply chain of these companies. As a result of these concerns, as well as those relating to potential production disruptions tied to geopolitical tensions, recession concerns impacting sales, and high financing rates reducing demand, we have adjusted our sector exposure accordingly.

- In recent years, the team has regularly passed on new issues of Integrated Oil & Gas companies (esp. long bonds), as the team is becoming increasingly concerned about stranded asset risks with traditional oil companies. While the companies are still generating very strong cash flows today, the energy transition is posing significant challenges requiring these companies to make substantial investments in technology to meet emission reduction targets and other environmental standards. Also, with increasing electrification of mobility, there is growing risk of oil losing its relevance as the main energy source. Since we only invest in strong companies in this space to begin with and in companies that have outlined a clear path towards emission reduction going forward, we are mostly staying away from long dated maturities of these issuers (e.g. >15yrs) as we have insufficient visibility on the long-term impact of the aforementioned.

9. Describe the climate-related risks and opportunities you have identified over the short, medium, and long term.

Although material/key climate-related risks do vary from industry to industry, the team expects transition risks to be something that will most likely have more impact in the short to mid-term. Physical risks related to climate change are on the other more likely to have greater impact in the medium to long term, as the frequency and intensity of climate change related disasters is more likely to increase.

In the Canadian landscape, the key sector that the team has identified to be exposed to transition risk is the energy space. In recent years, the team has regularly passed on new issues of Integrated Oil & Gas companies (esp. long bonds), as the team is becoming increasingly concerned about stranded asset risks with traditional oil companies. While the companies are presently generating very strong cash flows, the energy transition poses significant challenges and requires these companies to make substantial investments in technology to meet emission reduction targets and other environmental standards. Also, with increasing electrification of mobility, there is growing risk of oil losing its relevance as the main energy source. Since we only invest in companies that have outlined a clear path towards emission reduction going forward and in strong actors in this space, we are mostly avoiding long dated maturities of these issuers (e.g. >15yrs) as uncertainty around stranded assets etc. will challenge the business model over time.

Regarding physical risks, the team is still looking to get a better sense of assessing how these will impact specific sectors (e.g. insurance sector where we already observe increasing claims as a result of changing weather patterns). The IFI team is aware of the development of tools within Fiera to better capture the potential impact on portfolio returns; however, these still need to be refined. When the team believes there could be a material impact on the business or financial profile of an issuer due physical risk concerns, it is factored into the assessment of the issuer’s securities and the team modifies their judgement on the required returns to compensate for the additional risk factors.

10. Describe how you analyze the effectiveness of your investment strategy when taking into consideration different climate-related scenarios, including 1.5 degree and 2 degree Celsius warming scenarios.

When assessing the resilience of the investment strategy, the team currently relies on credit analysis factoring in their own proprietary research, but also extensively leverages MSCI ESG research and data. Using the MSCI data as a starting point, the team has created a proprietary ESG scoring system that completes the coverage out of scope from MSCI and also adjusts scores across the E, S and G pillars where the team has come to a different conclusion and reflective of their views. This proprietary Fiera ESG Score equips the team with the necessary data to more effectively compare the ESG profile and carbon metrics across issuers to better identify outliers and establish points of potential engagement with company management. Additionally, it helps the team to identify companies that require a higher degree of compensation for their assessed risk relative to peers.

The investment strategy is resilient and allows for consistent outperformance across market environments as a result of the investment process's dynamic approach which aims to exploit diversified sources of alpha. Top-down factors, including duration, yield curve, and sector positioning, allow the team to define their strategy and establish a quantitative framework. Bottom-up factors focus on credit research reviews which helps portfolio managers identify attractive securities. Environmental, Social and Governance (ESG) factors, including climate change related risks are accounted for in the fundamental analysis of a company because they have the potential to affect company value in the long run. Additionally, our ESG data provider provides us with different carbon metrics that are used in our own carbon monitoring and carbon attribution reports. The investment team has been increasingly incorporating carbon data into company analysis and leverages the data to work towards its goal to effectively quantify the carbon footprint of its portfolios in relation to their respective benchmarks.

While the team does not explicitly consider the 1.5 degree and 2 degree Celsius warming scenarios in its credit research, the portfolios are constructed to have a meaningfully lower carbon intensity than their respective benchmarks – coupling the lower average emissions and higher average ESG score with the strong performance track record gives the team confidence in the effectiveness of the investment strategy.

11. Do you track the carbon footprint of portfolio holdings?

Yes - Fiera Capital can provide carbon reports and carbon attribution reports for our different portfolios and benchmarks.

If yes, how frequently? Please provide the results as of December 31, 2023 and describe the methodology and metrics used, including whether you have set targets and/or a net zero objective for reducing the portfolio’s footprint, and comment on any related progress over the past year.

Through MSCI ESG research, we have access to carbon emissions data and other carbon related factors. Although emissions could be reported in multiple different ways, we most often use carbon emissions of scope 1 and scope 2 to calculate carbon intensity (total tons of CO2 equivalent normalized by total sales in M$USD). We generate these reports to our clients quarterly.

Our proprietary ESG scoring has also allows for customization to achieve client objective. This may include Fossil Fuel Free portfolios that excludes debt from energy companies, as well as issuers in nonenergy sectors with high carbon intensity, strategies focused on excluding issuers with a high risk of loss from current or past controversies and carbon intensity focused portfolios that seek to reduce the portfolio’s carbon footprint over time or relative to a benchmark.

12. What are your firm's emissions? Please demonstrate how/whether you are taking steps to reduce these emissions.

Similar to our investment portfolios, we are equally committed to minimizing our operational carbon footprint. In 2024, we partnered with Planet Mark to assist us in calculating our corporate GHG emissions across all our locations and we have since been awarded with their Planet Mark Business Certification. The Planet Mark certification is a recognized symbol of sustainability progress that verifies and measures carbon data, supporting efforts to cut emissions and contribute to the achievement of the SDGs.

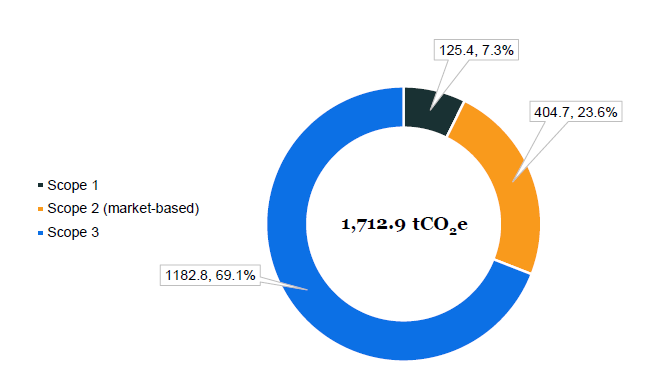

Summary of our operational emissions:

Reporting year:

January 1, 2023, to December 31, 20231

Reporting boundary:

Fiera Capital (Global Operations)

Highlights (market-based2):

Measured carbon footprint (tCO2e): 1,712.9 tCO₂e

Measured carbon footprint per employee (tCO2e): 2.0 tCO₂e

Measured emissions:

Scope 1: Diesel Fuel, Natural Gas

Scope 2: Electricity

Scope 3:

Cat. 1: Purchased Goods & Services (partial measurement)

Cat. 3: Fuel & Energy-Related Activities (partial measurement)

Cat. 5: Waste

Cat. 6: Business Travel

Cat. 7: Employee Commuting (partial measurement)

Measured Carbon Emissions by Scope for year 2023, tCO2e3:

1 Most recent data available

2 Market based method: A market-based method reflects emissions from electricity that companies have purposefully chosen (or their lack of choice).

3 Source: Planet Mark, Data as of December 31, 2023.

As part of Fiera Capital’s ongoing commitment to sustainability and corporate responsibility, we formed the Environmental Stewardship Committee in 2024. This committee is tasked with monitoring environmental initiatives, evaluating them, and proposing solutions to reduce the environmental footprint of our corporate operations.

Highlights for the year 2024 include:

- Data Collection: To better understand our environmental impact, we gathered data on the procurement of various office supplies, energy usage and water usage throughout 2023. This effort is laying the groundwork for informed decisions about reducing our environmental footprint, from procurement choices to operational habits.

- Collaboration With Our Property Manager: This year, we joined the first Sustainability Committee meeting with our property manager for our Toronto office. This collaboration marks a pivotal step in aligning our sustainability goals with those of our partners and peers.

- Initiating Waste Audits: Taking a closer look at waste management practices, we conducted the first floor -level waste audit in our Toronto office with the help of our property manager. By analyzing waste streams, we aim to identify areas for improvement and establish strategies to reduce waste.

- Harbour Square Park Shoreline Clean Up: Volunteers gathered at Harbour Square Park in Toronto to clean up shoreline, removing waste litter and helping to keep this cherished public space clean. This initiative not only improved the local environment but also provided a great team-based volunteering opportunity.

Furthermore, Fiera Capital attempts to conduct its operations in a carbon-neutral manner by reducing the carbon footprint of our operations as much as possible. Various grassroot-level initiatives are underway or being considered to improve the footprint, such as those related to employee travel.

To minimize the depletion of natural resources and to reduce waste and greenhouse gas emissions, Fiera Capital applies sound environmental practices to all operations. Depending on the office, these practices include but are not limited to:

- Improved sorting for recycling/garbage

- Eliminating single use products: straws, cups, water bottles

- Battery & electronic waste recycling

- Limiting energy usage by installing motion sensors on the floor and in offices, and using energy efficient lightbulbs

- Replacing bottled water with pitchers for onsite meetings

- Considering more sustainable, local caterers that use either reusable plates/cutlery or compostable containers

- Incorporating sustainable considerations for office supplies that limit waste and are more earth-friendly (less plastic)

Additionally, our office building in Toronto has a BOMA Go Green Plus Certification and holds RCO The Recycling Council of Ontario – Green Team, among other awards.

13. For the mandate you manage for Queen’s, what percentage of equity holdings (if applicable) have credible net zero commitments?

Not applicable for fixed income investments.

14. How do you assess the credibility of a company’s emission reduction targets?

The team believes that engagement can improve issuer performance and reduce an issuers risk profile across sectors, while better aligning issuer’s behavior with our client’s interests. In advance of engagements, we set clear objectives of what we want to achieve and this can vary across issuers dependent on their ESG risk exposure, sector or past history. At a high level, the objectives typically revolve around:

- Establish or understand emission reduction targets and if they have been publicly disclosed

- Transparency around target setting/intentions

- Data and disclosure around specific ESG factors, in particular carbon emissions and intensity with expected improvement in accuracy and inclusion of Scope 3 over time

- Request further data and verify currently published data to make sure we can accurately compare companies within the sector and adequately assess emission elated risks

Our objective is to understand clearly the company’s intentions, strategy and targets, and ensure we have proper data and disclosure to track progress to hold management accountable.

15. What forward-looking metrics do you use to assess an investment’s alignment with global temperature goals?

The credit team focuses on engagement as their most effective tool to translate portfolio decarbonization to economy decarbonization. The Canadian energy sector produces significant GHG emissions and faces heightened levels of scrutiny from investors and other stakeholders. There is a real risk that energy companies will face funding challenges in the future if they do not address this issue and do not sufficiently disclose data on their emissions and set clear emission reduction targets.

A key objective of the team has been to clearly understand how energy companies within our coverage will get to their 2050 Net Zero target, including what resources are they putting in place, what investments are they planning to make, and what interim targets have they established to assess progress, among others. The team needs to ensure that issuers take these issues seriously and are not simply making loose commitments.

Overall, we believe engagement is the most effective tool to translate portfolio decarbonization to economy decarbonization. We are not interested in companies simply selling off their dirty assets to other actors, which in effect reduces emissions of the selling issuers so they appear greener but does not improve emissions overall. Rather, we encourage issuers towards the decommissioning of “brown” assets (where possible) to be replaced by green technology. We believe that remaining engaged, laying out expectations, and giving companies time to execute on their transition strategy, while still holding companies accountable in the interim is an effective strategy to address climate related risks and align with global temperature goals.

16. Has your firm produced a Task Force on Climate-Related Financial Disclosures (TCFD) report? If yes, please provide a link to the most recent report.

Yes, we publish a Climate Report annually. Please see our 2023 Climate Report here: https://www.fieracapital.com/wp-content/uploads/page/31/fiera-2023-climate-report.pdf

Our Sustainable Investing team is currently working on our 2024 Climate Report that is set to be published in Q2 2025.

17. Has your firm produced a Sustainability Accounting Standards Board (SASB) report? If yes, please provide a link to the most recent report.

No.

Diversity

18. Please provide the composition of your senior leadership team and board of directors, including women and visible minorities. How do you encourage diversity of perspectives and experience?

Diversity of thought and perspective fuels our ability to generate innovative solutions, enabling us to build sustainable prosperity for all our clients. At Fiera Capital, creating a respectful, inclusive, and supportive culture is integral to our ability to collaborate, generate competitive business insights and make better decisions. While we pursue our growth and expansion, we aspire to reach a level of diversity that reflects the world in which we live, and the communities and enterprises that we service globally.

Since beginning our DE&I journey, we have made significant strides and are putting the full force of the organization toward strengthening our foundation by:

- Strengthening our pipeline of top talent with greater inclusion of women in management positions;

- Promoting greater representation of diverse racial and ethnic groups to create workforce that reflects the communities and organizations we serve around the world; and

- Improving our Inclusion scores, such as Allyship, Well-being, and Protective Mechanisms;

Our DE&I strategy is built on four key pillars, each designed to achieve specific goals informed by our Inclusion survey, industry benchmarking, and best practices.

- Inclusive Workforce: Strengthen our culture of inclusion and belonging to ensure our people excel and foster innovative solutions to meet the evolving needs of our clients.

- Inclusive Workplace: Cultivate an inclusive, equitable environment by embedding DE&I in our policies, practices, and programs in order to promote equity and career progression.

- Inclusive Partnerships: Develop strategic partnerships with external organizations that empower the communities and clients we serve and support regionally.

- Data & Insights: Provide transparency on our progress in diversity representation and career advancement.

The implementation and success of Fiera Capital’s DE&I strategy are driven by the collective efforts of employees from across the organization, led by the Global Head of Diversity, Equity & Inclusion, and supported by a group of nearly 90 Fiera Capital employees who make up the Global DE&I Council, Ambassador Network, and Employee Resources Groups.

Below are some of our key initiatives and achievements to date:

- Fiera Capital’s new Global Parental Leave Policy, which is more competitive and inclusive.

- To foster a culture of inclusion, we regularly launch trainings on Unconscious Bias, Respect at Work, and Allyship for all employees. We also regularly host global events with executive team members and renowned speakers to promote workplace inclusion.

- A cohort of women at Fiera Capital participates annually in The A Effect’s Ambition & Leadership Challenge, a program designed to help participants embrace ambition and maximize leadership potential. Graduates of this program are offered opportunities for mentorship and continued growth through our internal Women at Fiera Community.

- Bronze Level Parity Certification from Women in Governance in the US and Canada (maintained since 2022), a diagnostic tool that provides an analysis of strengths and opportunities to achieve greater equity and inclusion in our practices.

- Indigenous Engagement and Inclusion Pledge, launched in January 2024, which demonstrates our commitment to building meaningful partnerships that further Indigenous empowerment.

- Employee Resource Groups that support Women, BIPOC, LGBTQ+, Mental Health, and Working Parents.

- Fiera Capital’s Volunteering Program, launched in January 2024, offering employees one paid day annually to participate in a volunteer activity during business hours that will drive positive change in the communities where Fiera Capital operates.

- Fiera Capital’s new Global Recruitment Policy ensures a consistent and fair approach to recruitment while promoting diversity and attracting qualified talent.

- Partnerships with the Ivey Business School’s WAM (Women in Asset Management) Program, that supports the diversification of Canada's future workforce in finance and better reflects the changing demographics of our emerging markets and clients.

- We became one of the first 16 signatories of the new CFA Institute Diversity, Equity, and Inclusion Code for the Investment Profession in the United States and Canada. This comprehensive voluntary code fosters institutional commitments to DE&I action, leading to greater inclusion of diverse viewpoints from the best talent, better investment outcomes, improved working environments, and a cycle of positive change for future generations.

- Fiera Capital received the Diversity, Equity and Inclusion award at the Institutional Connect Awards in 2024, that recognizes the outstanding and authentic commitment of the firm in its inclusion efforts, within the organization and with external partners.

Our collective efforts are having an impact on our diversity representation and is helping to create an inclusive working environment where everyone can bring their full self to work.

As for the composition :

Board Members Gender reprensentation:

Male : 70%

Female 30%

Board Members Ethnicity reprensentation:

Not disclosed

Senior Leadership Gender representation:

Male 100%

Senior Leadership Ethnicity representation:

White :87.5%

Declined to answer : 12.5%

Proxy Voting

19. Do you use an external proxy voting service such as ISS or Glass Lewis? If yes, please specify.

Yes - Institutional Shareholder Services Inc (“ISS”).

20. If the answer to the previous question is no, please describe your proxy voting guidelines.

Not applicable.

21. If you use an external proxy voting service, do you customize your guidelines for proxy voting? If yes, describe your customized guidelines. If you use the default service guidelines, describe how often and in which situations you deviate from the external proxy voting service recommendations.

Fiera Capital and its portfolio managers do not delegate the proxy voting responsibility to a service provider. However, we hire the services of an external proxy advisory service provider to generate recommendations as well as customized voting recommendations based on Fiera Capital’s guidelines. The service provider helps manage the proxy voting process in collaboration with the sustainable investing team and each investment management team’s dedicated individuals who oversee share voting.

The current service provider is Institutional Shareholder Services Inc. (“ISS”), an independent firm with expertise in global proxy voting and corporate governance issues, to augment our internal processes. ISS provides transparency to its clients on the status of their votes, as reflected in the change from votes being instructed/approved to being sent/confirmed.

In 2024, 93% of our votes were aligned with our service provider’s recommendations. While our service provider’s research is an input in the analysis of the proxies we vote for, our voting decisions are taken independently from their recommendations.

22. What proportion of the time do you vote with or against management on shareholder resolutions, board appointments, and auditor appointments? What proportion of the time do you vote with or against management on ESG issues? How does this break down for climate, diversity, and remuneration issues?

Please find attached to this questionnaire Fiera Capital’s 2024 proxy voting statistics.

Engagement

23. What are your engagement goals? Are these goals outcome/action-based (e.g. decreases in emissions or increases in number of women on the board) or means-based (reporting on emissions or number of women on the board)?

The IFI team regularly engages with issuers on ESG related subjects with the goal of positively impacting issuer behavior. To this end, the team has held over 500 meetings with corporate management teams since 2019, including over 190 ESG engagements.

The team believes that engagement can improve issuer performance and reduce their risk profile, while better aligning issuer behaviour with our clients’ interests. As the team is actively participating in funding discussions with corporate issuers on an ongoing basis, the team’s exposure to management teams is significant and the nature of the discussions gives the team the right levers for engagement.

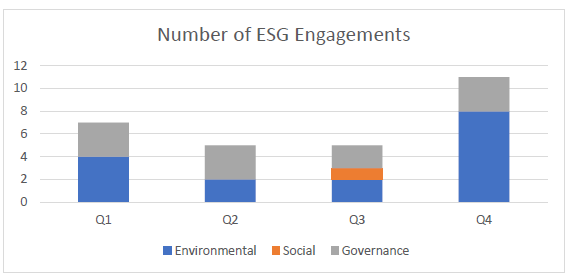

Breakdown by Area of Engagement

Number of Management Meetings: 66

Number of ESG Engagements: 28

Breakdown by Area of Engagement:

- Environmental: 16

- Social: 1

- Governance: 11

24. What is your policy around the escalation of engagement; how and why might this happen and what is the ultimate tool you might use (e.g. voting against board re-election, etc.)?

As the team is actively participating in funding discussions with corporate issuers on an ongoing basis, the team’s exposure to management teams is significant and the nature of the discussions gives the team the right levers for engagement. Should an engagement not deliver the right outcome and/or the team will conclude that they are not adequately compensated for ESG specific risks related to the issuer, the team would typically pass on the new issue and/or provide specific feedback to the issuer (either directly or through the dealers). Additionally, in some cases where they already have substantial exposure to an issuer, the team might decide to exit a bond position. Since they are fixed income investors, voting against board re-election etc. are tools that are typically not available to them.

25. Describe a specific example of your firm’s engagement with a company over the past year, including the outcome and any lessons learned.

Engagement with a global auto manufacturer that recently established a Canadian bond market program

During Q1 2024, we engaged with the management of the global auto manufacturer's Canadian subsidiary on multiple occasions. Since the Canadian entity's inaugural bond issuance in 2021, we have consistently expressed our desire to have readily available financial statements from the issuing entity, which is part of a globally renowned automotive group. Despite the fact that market participants did not specifically require such disclosures from the Canadian entity, and while the entity was not legally mandated to publicly report on its own, our team voiced our concerns to the issuer each year.

As a result of our efforts, in Q1 2024, the entity, alongside its ultimate parent, agreed to provide audited financial statements in a timely manner. Additionally, the entity will also provide, through a dedicated website, full access to their Canadian arm-only financial statements, enabling us to better assess the performance of Canadian assets.

Engagement with a Canadian REIT on governance and related party transactions.

In Q3 2024, we met with management of a major Canadian REIT to discuss, among other topics, governance concerns regarding related-party transactions between the Company and entities owned, in part of in full, by members of senior management. This had been a long-standing concern for us as a small number of individuals may have had disproportionate control relative to what was implied by simple ownership stake. We had met with the company six times since 2019 and repeatedly flagged the lack of transparency around ownership & control, as well as the lack of independence regarding internal oversight, as a significant concern.

At the meeting, management highlighted improvements to governance since the appointment of the new CFO, including full independence of all members of both the Finance and Audit committees. We were informed that the Board was reviewing several agreements for the transactions in question to either renegotiate or lapse them entirely. As we had voiced our concerns on this matter in the past, this engagement represented a significant positive step towards addressing our concerns. We will follow developments closely and will schedule the next meeting in due course.

Engagement with a Japanese auto manufacturer regarding transition related risks

In Q4 2024, as part of our ongoing ESG initiatives with the automotive sector, we conducted a thorough comparison of issuers within the industry to assess the various risks faced by each constituent relative to others. We held another meeting with a Japanese auto manufacturer to gain a deeper understanding of the environmental risks the issuer is encountering, including emissions targets and related reporting, as well as identifying potential legal fines and penalties they may face. The sector is undergoing a substantial transition (electrification), which presents ample opportunities but also bears significant risks. By maintaining a prudent and cautious approach towards the sector and by continuing our ongoing discussions with issuers, we ensure that we are adequately compensated on a risk-adjusted basis.