The following information is provided to ensure accurate and timely payments and to aid in easy navigation to your pay advice slips and tax information.

Employees are responsible for maintaining their Direct Deposit banking information in MyHR Employee self-service.

Please note: Incorrect entries may cause delays in salary payments.

HOW TO GET YOUR BANKING INFORMATION:

- Log onto your bank to get the information often referred to as "Direct Deposit Authorization" or "Direct Deposit/Payroll Form"

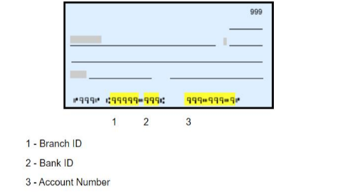

- Using a personal cheque

- Do not use your bank card

- Do not use any account other than a chequing or savings account

Once you have your banking information, please follow these step-by-step instructions:

How to Add or Update your Direct Deposit Information in MyHR

In emergency cases only, Payroll Services can assist you by adding/updating your Direct Deposit banking information. To complete this entry, we will require the following:

- Complete the Direct Deposit Authorization Form (PAY-FRM-031) (PDF, 218 KB)

- Download from your Financial Institution, a Direct Deposit authorization form or scan a copy of a void cheque.

- Send an email to Payroll.services@queensu.ca requesting to have your banking added or updated, ensuring you have attached both documents.

- Please note that if no banking information is entered, the first payment will be issued via cheque and mailed to your home address. Any subsequent cheques may be held in Financial Services until banking information has been entered into MyHR self-service.

Queen's Payroll Services will calculate how much income tax to deduct by referring to the total claim amount on your TD1 Federal and TD1ON Provincial Forms.

- Complete both forms to ensure accurate tax deductions. Submit completed forms to Payroll Services via email Payroll.services@queensu.ca or drop off between 8 am to 4pm Monday to Friday, to 355 King Street West, 3rd floor.

- TD1 Fed Form (PDF, 153.2 KB)

- TD1ON Prov Form (PDF, 168.3 KB)

For CRA compliance, the name on your Pay Advice slip and Tax slip must be identical to your name on your SIN card or letter. Please log onto your MyHR Self-Service account and verify your name in the system with your SIN card or SIN letter.

- If the names are identical, no further action is required.

- If the names are different, please contact Human Resources at hradmin@queensu.ca, requesting them to update your name. Please add your Employee ID number in the email. To ensure Privacy, do not add your SIN number or attach a copy of your SIN card or letter to your email.

Pay advice notices are normally available 5 days prior to your payday and can be viewed via MyHR Self-Service.

T4/T4A tax slips are available by the end of February each year, via MyHR Self-Service.

Ensure that you give T4/T4A Consent via MyHR Employee self service by the end of January.

Casual, Monthly, and Biweekly payroll calendar schedules and cutoff dates are available for the year.